Annual budgets are probably the truest measure of a government’s priorities and vision, or lack thereof. The most recent B.C. NDP budget, passed with the help of the Greens, was widely characterized as a “stand pat” exercise – so much so that reporters didn’t have enough questions to fill their allotted time with the finance minister.

But it’s hard to square the outlook that underpins this budget with global economic trends. While we have enjoyed a lengthy period of economic expansion, a slowdown has already taken hold in China and Europe, and the predominant view among economists is that 2018 is likely to have been the economy’s high point for some time to come.

If ever we needed a focus on productivity, competitiveness, and maximizing the economic benefit from every public dollar spent, now is the time. Yet we saw none of that in the NDP budget. In fact, debt accumulation, spending and tax levels are all heading in the wrong direction and at a troubling pace.

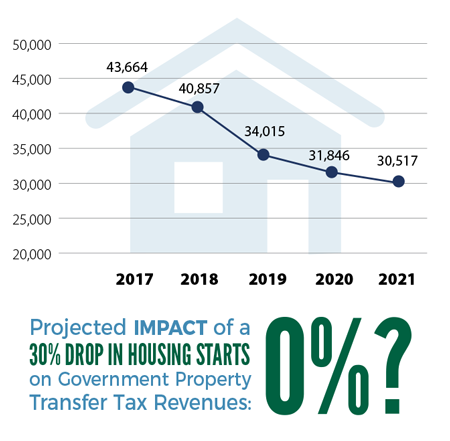

Added burdens like these will be a further drag on already slowing investment, growth and job creation. The budget was frightening in acknowledging such an impact in the construction sector – a projected 30 per cent drop in housing starts over the NDP’s term of office. Winter is coming, economically speaking, and NDP mismanagement is going to make it tougher to weather the storm that is closing in.

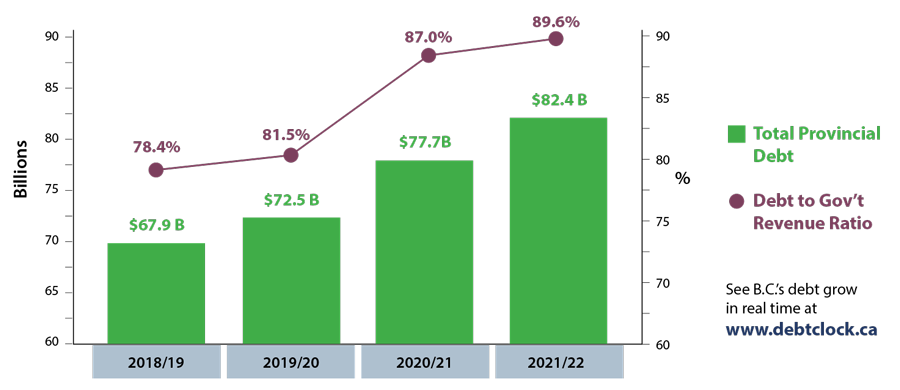

The Debt Clock is Spinning Back Up

Ratios relate to taxper-supported debt only, excluding self-supported debt (averaging $226B over four years)\

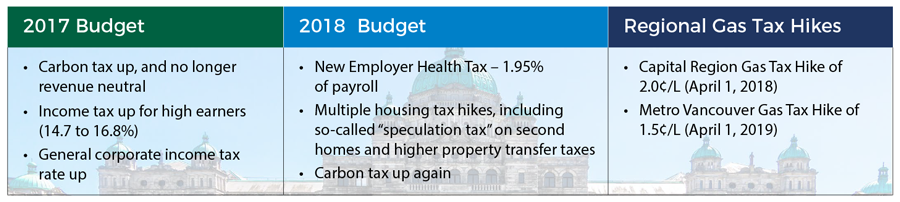

The NDP Agenda: Keep Raising Taxes

The absence of new taxes in the 2019 NDP budget had less to do with restraint, and more to do with the hikes and other added burdens that it packed into its previous two budgets and other measures. They included:

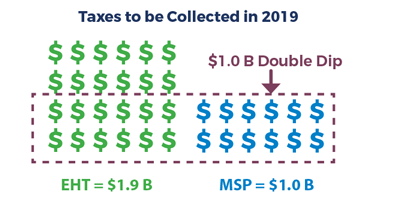

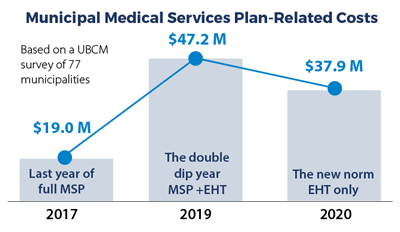

The Health Tax Double Dip

A new NDP payroll tax came into effect January 1, 2019 – the Employer Health Tax (EHT) – but the Medical Services Premiums (MSP) it’s meant to replace are still being collected this year. The budget confirms the cost impact for businesses, which in turn will have a chilling effect on jobs and investment.

New Health Tax = Higher Property Taxes

New Health Tax = Higher Property Taxes

Since public sector employers pay the Employer Health Tax, municipalities will be looking for a way to recoup it. You can probably look no further than your property tax bill to see how that will happen.

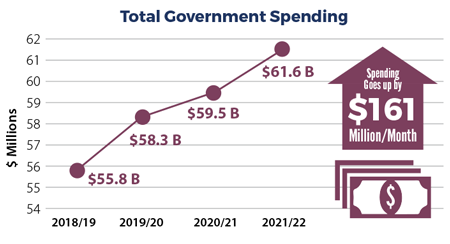

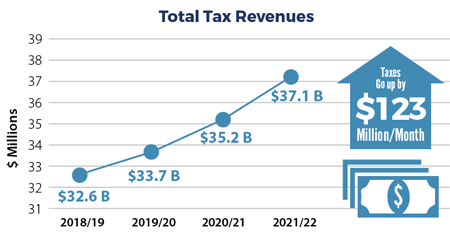

Feed a High-Spending Habit

Feed a High-Spending Habit

At a time when governments elsewhere are wisely focused on competitiveness and restraint, the B.C. budget includes a 10 per cent hike in its total spending over three years, amounting to $5.8 billion. The NDP Government has raised a tax or introduced a new tax once every 3.5 weeks since it was elected.

A Precarious Balance and Bad Money Management

A Precarious Balance and Bad Money Management

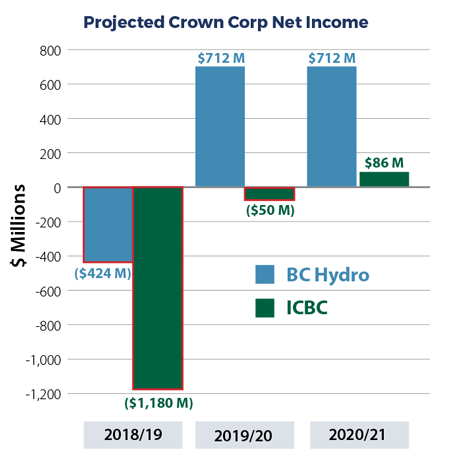

Wishful Thinking: Projected Crown Corp Revenue

The NDP is planning on big debt increases. But overblown revenue expectations will probably make things even worse. The NDP are banking on a massive turnaround in the performance of two of the largest Crown corporations – a high stakes gamble that is likely to translate into serious rate increases.

Housing Starts Set to Plunge

Housing Starts Set to Plunge

For the construction industry, the single most troubling number in the budget was the projected 30 per cent drop in housing starts. Given that construction accounts for nearly 10 per cent of the B.C. economy, this contraction will be widely felt. It underscores the flaws in an NDP housing strategy that’s based on higher taxes, with little regard for increasing supply, and casts further doubt on revenue projections.

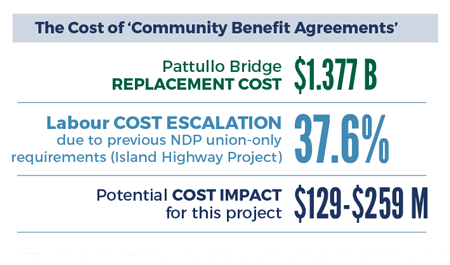

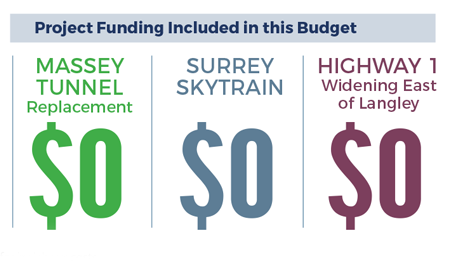

Spend More, Get Less

For all their big spending ways, the NDP couldn’t carve out a penny to begin several major and muchneeded infrastructure projects. That’s due in part to massive overpayment for the work thanks to socalled ‘Community Benefit Agreements’ that exclude nonunion labour. In addition to violating fundamental workers’ rights, these agreements will drive up labour costs by more than a third.

CFIB estimates July 2019; range depends on portion of project budget accounted for by labour costs.

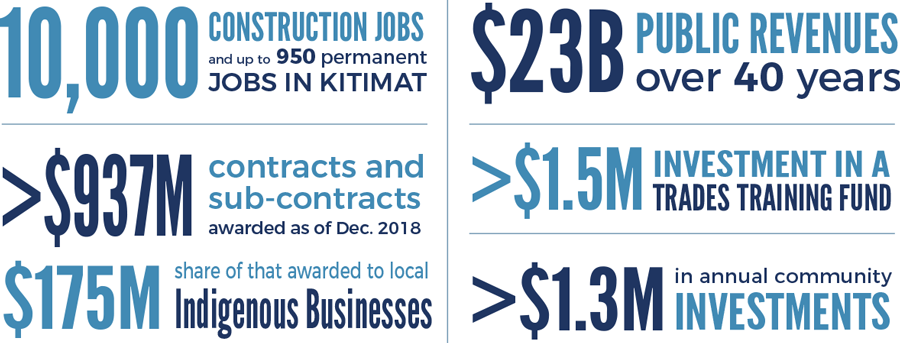

One Budget Bright Spot: LNG Canada

Successive B.C. governments have worked for years to bring an LNG industry to our province. The vision is to liquefy clean-burning B.C. natural gas – at newly built facilities with world-leading environmental practices – and to ship it to high-demand Asian markets where it will help offset heavier-carbon fuels.

That vision became reality last October when LNG Canada announced the go-ahead for a plant now being built in Kitimat.

The Investment

The Benefits

The Environment

The Environment