ICBA NEWS: Chris Gardner Named one of BIV’s Most Influential Business Leaders

by ICBA | Aug 17, 2021 | ARTICLES & OPINIONS

Congratulations to ICBA president Chris Gardner on being named to Business in Vancouver’s 2021 list of most influential business leaders in British Columbia. We’re proud to have Chris leading us! More at...NEWS RELEASE: Nothing for Job Creators and Employers in NDP Budget: ICBA

by ICBA | Feb 18, 2020 | ARTICLES & OPINIONS

Small businesses – including thousands in construction – looking for relief from higher taxes, suffocating red tape and other anti-employer policies enacted by the BC NDP Government over the past three years, got nothing in today’s 2020-21 BC Budget, says the...TRAINING THURSDAY: Building Code for Residential Builders

by ICBA | Oct 24, 2019 | ARTICLES & OPINIONS

TRAINING THURSDAY: Building Code for Residential Builders Are you a home builder in BC? We have a brand-new course for you! Our Building Code for Residential Builders session is in Langley November 14. Participants will learn how to read, interpret and use the BC...TRAINING THURSDAY: Effective Management Skills

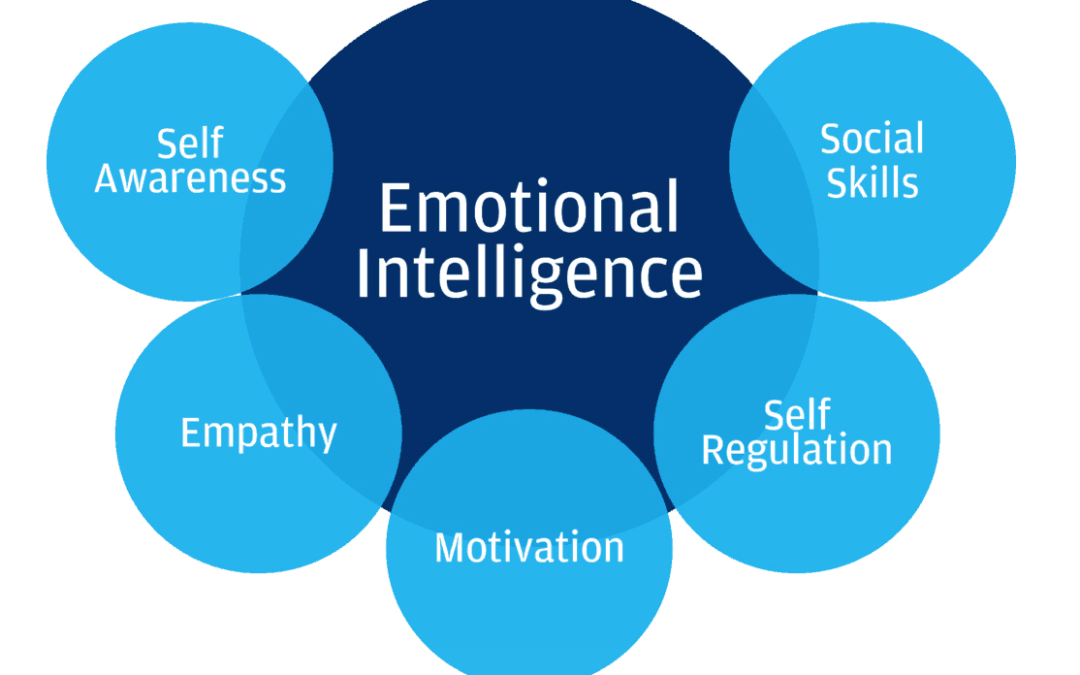

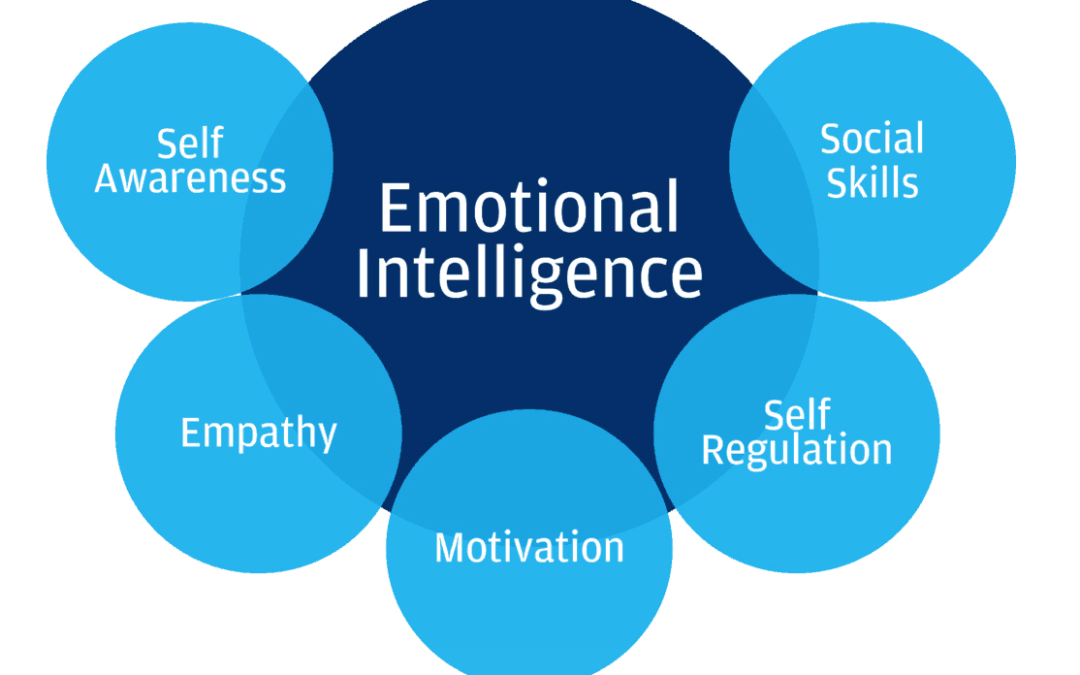

by ICBA | Aug 1, 2019 | ARTICLES & OPINIONS

Are you an effective manager? Could you be better? Check out our Effective Management Skills workshop! How much untapped potential, energy, commitment and creativity currently exists within your organization, team or department? What would it mean to your culture and...Follow ICBA on Facebook

WELLNESS WEDNESDAY #146: Take Me Out To The Ballgame![]()

![]() There’s something comforting to me about watching baseball, whether live or on TV. The slower pace slowly relaxes you, yet the big moment is always a single swing of the bat away.

There’s something comforting to me about watching baseball, whether live or on TV. The slower pace slowly relaxes you, yet the big moment is always a single swing of the bat away.![]()

![]() I read a great piece on Psychology Today about the mental health lessons of baseball. It suggests that the high rate of failure is helpful, noting that being a career .300 hitter in baseball is a Hall of Famer: “This means that the best of the best in the sport will fail 70 percent of the time. This is why baseball, more than any other sport, has failure built into it.”

I read a great piece on Psychology Today about the mental health lessons of baseball. It suggests that the high rate of failure is helpful, noting that being a career .300 hitter in baseball is a Hall of Famer: “This means that the best of the best in the sport will fail 70 percent of the time. This is why baseball, more than any other sport, has failure built into it.”![]()

![]() No one likes failure, but it is a part of life, and often a building block for future success.

No one likes failure, but it is a part of life, and often a building block for future success. ![]()

![]() So when I watch one of my Blue Jays swing and miss, I guess I can feel better about the project that went awry, the post that didn’t quite land write, or the decision government made that I disagree with.

So when I watch one of my Blue Jays swing and miss, I guess I can feel better about the project that went awry, the post that didn’t quite land write, or the decision government made that I disagree with.![]()

![]() “For us to achieve what we want to achieve, failure is a must, so the sooner we become okay with it, the better… If we’re not failing, we’re not working on hard enough problems.”

“For us to achieve what we want to achieve, failure is a must, so the sooner we become okay with it, the better… If we’re not failing, we’re not working on hard enough problems.”![]()

![]() Here’s to failing upward!

Here’s to failing upward!![]()

![]() -----

-----![]() Each week, ICBA’s Jordan Bateman reflects on what we’ve learned as we participate in ICBA’s Workplace Wellness Program. ICBA’s Workplace Wellness Program is helping more than 100 companies and more than 10,000 construction professionals better understand mental health. This program is free for all ICBA members – check out icba.ca/wellness for details.

Each week, ICBA’s Jordan Bateman reflects on what we’ve learned as we participate in ICBA’s Workplace Wellness Program. ICBA’s Workplace Wellness Program is helping more than 100 companies and more than 10,000 construction professionals better understand mental health. This program is free for all ICBA members – check out icba.ca/wellness for details.

Our Jock Finlayson digs into #cdnpoli #Budget2024 and finds it continues 3 alarming Trudeau Government trends.![]()

![]() 😑 Economic stagnation

😑 Economic stagnation![]() 👷♂️ Weak private sector investment

👷♂️ Weak private sector investment![]() 💸 Spending way too much

💸 Spending way too much![]()

![]() Read his ICBA Economics analysis at www.icbaindependent.ca/2024/04/17/icba-economics-trudeau-government-creating-difficult-fiscal-leg...

... See MoreSee Less

Read his ICBA Economics analysis at www.icbaindependent.ca/2024/04/17/icba-economics-trudeau-government-creating-difficult-fiscal-leg...

... See MoreSee Less

When 70% of Canadians tell a pollster that "everything is broken," one expects the government to take that seriously.![]()

![]() Justin Trudeau didn't. And Budget 2024 will make things worse, says ICBA President Chris Gardner. Check out his op-ed 👇

... See MoreSee Less

Justin Trudeau didn't. And Budget 2024 will make things worse, says ICBA President Chris Gardner. Check out his op-ed 👇

... See MoreSee Less

ICBA OP/ED: Trudeau Government Doubles Down on Missing the Mark

www.icbaindependent.ca

The following op-ed, written by ICBA President and CEO Chris Gardner, was first published in Business in Vancouver on April 16, 2024. Earlier this year, public opinion research company Leger published...

Trudeau Government Can’t Tax-and-Spend its Way to Canadian Prosperity: ICBA (News Release)![]()

![]() The 2024 federal budget continues the Trudeau Government’s legacy of excessive spending, bloating bureaucracy, high taxes, and doing nothing to reverse Canada’s withering economic productivity and competitiveness, says the Independent Contractors and Businesses Association (ICBA), one of Canada’s largest business associations.

The 2024 federal budget continues the Trudeau Government’s legacy of excessive spending, bloating bureaucracy, high taxes, and doing nothing to reverse Canada’s withering economic productivity and competitiveness, says the Independent Contractors and Businesses Association (ICBA), one of Canada’s largest business associations.![]()

![]() “The torrid pace of spending by Ottawa and the growth of government is simply breathtaking,” said Chris Gardner, ICBA President and CEO. “The Trudeau Liberals are doubling-down on a very bad idea – that government is the centre of everything and that there is no challenge facing Canada that billions and billions in new spending, ever-higher taxes, and overregulation will not solve.”

“The torrid pace of spending by Ottawa and the growth of government is simply breathtaking,” said Chris Gardner, ICBA President and CEO. “The Trudeau Liberals are doubling-down on a very bad idea – that government is the centre of everything and that there is no challenge facing Canada that billions and billions in new spending, ever-higher taxes, and overregulation will not solve.”![]()

![]() Housing was a prime political focus of Budget 2024, but ICBA – Canada’s largest construction association – remains highly skeptical that the Trudeau Government’s spending will do much to move the needle on housing affordability. The supply shortage is so acute that government cannot simply spend its way out of it – it must unleash private sector builders.

Housing was a prime political focus of Budget 2024, but ICBA – Canada’s largest construction association – remains highly skeptical that the Trudeau Government’s spending will do much to move the needle on housing affordability. The supply shortage is so acute that government cannot simply spend its way out of it – it must unleash private sector builders.![]()

![]() “A federal go-it-alone approach to housing will not work,” said Gardner. “The sheer volume of pre-budget announcements on housing and the billions committed by Ottawa reveals the sense of panic that has gripped the federal government. The policies are disjointed, ill-conceived, confusing, and often conflict with those of not only other levels of government but also of Ottawa itself. None of this is going to deliver any meaningful relief to Canadians being crushed by the weight of the affordability crisis.”

“A federal go-it-alone approach to housing will not work,” said Gardner. “The sheer volume of pre-budget announcements on housing and the billions committed by Ottawa reveals the sense of panic that has gripped the federal government. The policies are disjointed, ill-conceived, confusing, and often conflict with those of not only other levels of government but also of Ottawa itself. None of this is going to deliver any meaningful relief to Canadians being crushed by the weight of the affordability crisis.”![]()

![]() The Trudeau Government missed its opportunity to address the inherent systemic problems holding back Canadian prosperity.

The Trudeau Government missed its opportunity to address the inherent systemic problems holding back Canadian prosperity.![]()

![]() “Canada faces a trifecta of closely linked economic problems: stagnant productivity, a pattern of weak business investment, and declining global competitiveness. Unfortunately, there is little in Budget 2024 that tackles these problems in a meaningful way,” said Jock Finlayson, ICBA Chief Economist. “Expanding the size and cost of government won’t reverse the negative trends that are weighing on living standards and sapping Canada’s economic vitality.”

“Canada faces a trifecta of closely linked economic problems: stagnant productivity, a pattern of weak business investment, and declining global competitiveness. Unfortunately, there is little in Budget 2024 that tackles these problems in a meaningful way,” said Jock Finlayson, ICBA Chief Economist. “Expanding the size and cost of government won’t reverse the negative trends that are weighing on living standards and sapping Canada’s economic vitality.”![]()

![]() Running massive, ongoing deficits to try and pay for the government’s wild spending is especially concerning to ICBA and will further hamper economic growth.

Running massive, ongoing deficits to try and pay for the government’s wild spending is especially concerning to ICBA and will further hamper economic growth.![]()

![]() “What Canada desperately needs is more private sector investment in productive assets such as machinery, equipment, buildings and other structures, advanced process technologies, intellectual property products, and transportation, communications and engineering infrastructure,” said Finlayson. “Budget 2024 suggests the federal government falls short of addressing this enormous challenge.”

... See MoreSee Less

“What Canada desperately needs is more private sector investment in productive assets such as machinery, equipment, buildings and other structures, advanced process technologies, intellectual property products, and transportation, communications and engineering infrastructure,” said Finlayson. “Budget 2024 suggests the federal government falls short of addressing this enormous challenge.”

... See MoreSee Less

Have our friends at Epscan Industries Ltd. gone batty? Apparently -- they've donated 200 take-home bat🦇 kits to the Fort St. John North Peace Museum. ![]()

![]() What a fun way to support a great community cause!

... See MoreSee Less

What a fun way to support a great community cause!

... See MoreSee Less

💰 GDP per capita flatlines.![]() 💸 Productivity stagnates.

💸 Productivity stagnates. ![]() 📉 Output per hour has fallen in 11 of the past 14 quarters – an unprecedented development, and one not replicated in the U.S. or most other advanced economies.

📉 Output per hour has fallen in 11 of the past 14 quarters – an unprecedented development, and one not replicated in the U.S. or most other advanced economies.![]()

![]() It's a grim situation for the Canadian economy, and one next week's federal budget must address, says ICBA Chief Economist Jock Finlayson.

It's a grim situation for the Canadian economy, and one next week's federal budget must address, says ICBA Chief Economist Jock Finlayson.![]()

![]() Read his budget preview blog at www.icbaindependent.ca/2024/04/11/icba-economics-thoughts-on-canadas-productivity-crisis/.

Read his budget preview blog at www.icbaindependent.ca/2024/04/11/icba-economics-thoughts-on-canadas-productivity-crisis/. ![]()

![]() (WARNING: the stats may cause heartburn and heartache for those wanting to see Canadian prosperity grow.)

... See MoreSee Less

(WARNING: the stats may cause heartburn and heartache for those wanting to see Canadian prosperity grow.)

... See MoreSee Less

Tweet ICBA!

WELLNESS WEDNESDAY #145: Thank a Construction Worker!

April is Construction Month in B.C., and as gratitude is an important part of practicing mental wellness, we’d like to take this opportunity to thank all of our construction professionals... More at https://www.icbaindependent.ca/2024/04/10/wellness-wednesday-145-thank-a-construction-worker/