By Jock Finlayson, ICBA Chief Economist

With the release of Statistics Canada’s December Labour Force Survey, we now have the data to assess the performance of the B.C. job market over the past year. Below, I summarize the highlights and some key trends in the province’s labour market in 2023, under the headings of “good,” “bad”, and “ugly.”

The Good

December saw a seasonally-adjusted gain of 17,700 jobs vs the month before, equating to a solid 0.6% advance. (Note that these figures include payroll jobs plus self-employed positions and represent annual averages.) For 2023 as a whole, the province added roughly 44,000 jobs.

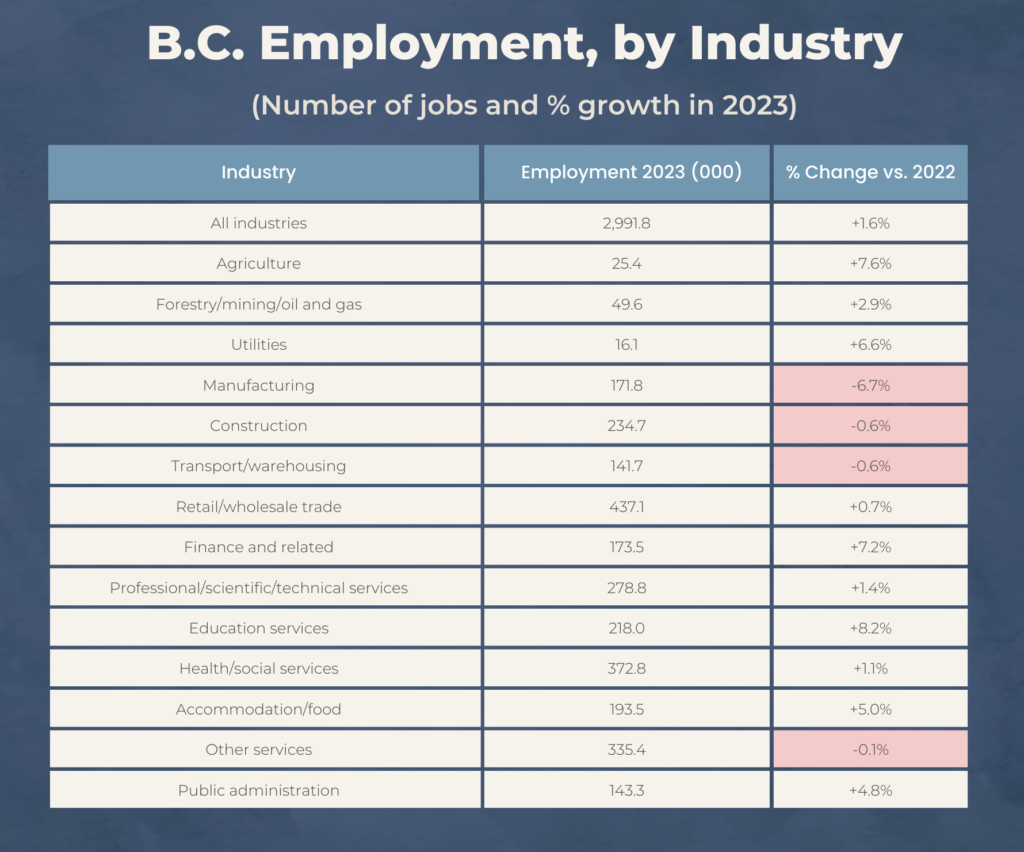

Several B.C. industries added to their payrolls last year (Table 1), with notable percentage increases reported in educational services, agriculture, finance, utilities, and accommodation and food services. Perhaps surprisingly, employment in the broad health care sector climbed by just 1.1%. And while one can debate whether this qualifies as “good” news, public administration jobs – across all levels of government, but excluding people working in health care, education and social services – increased by almost 5% in 2023; compared to 2019, public administration positions are up by approximately 18%.

The Bad

Amid a growing labour force, unprecedented immigration inflows, and a slowing economy, B.C.’s unemployment rate moved higher in 2023. Over the year, unemployment averaged 5.2%, compared to 4.6% in 2022 (The unemployment figures are actuals rather than seasonally-adjusted). Despite evidence of a tight job market and widespread concerns about labour shortages, the unemployment rate is now materially higher than it was in the pre-pandemic years of 2018-19.

The employment rate – the share of the population aged 15 and over that’s employed– dipped in 2023, averaging 61.8%, down from 62.1% the year before. In the three years preceding the pandemic, B.C.’s employment rate hovered in the range of 62.6% – 63.1%. The gently falling employment rate likely reflects a combination of population aging and a private sector economy in which some industry sectors are shrinking or unable to grow, as discussed below.

A handful of B.C. industries posted absolute job losses last year (Table 1 above), including manufacturing (down 6.7%), transportation and warehousing, construction, and “other services.” Employment in all goods-producing industries (manufacturing, construction, utilities, farming and fishing, and other natural resource extraction and processing industries) collectively decreased by 1.8%.

The Ugly

Some readers may be surprised that B.C. ranked dead last among the provinces in job growth last year (Figure 1). Even with a surging population, hefty increases in government spending, and a ballooning public sector payroll, B.C. significantly underperformed the national average in overall job creation in 2023 (as it also did in 2022), reporting much weaker job growth than Alberta, New Brunswick, PEI, and Ontario. This is one piece of evidence signaling a possible erosion in the foundations of sustainable prosperity.

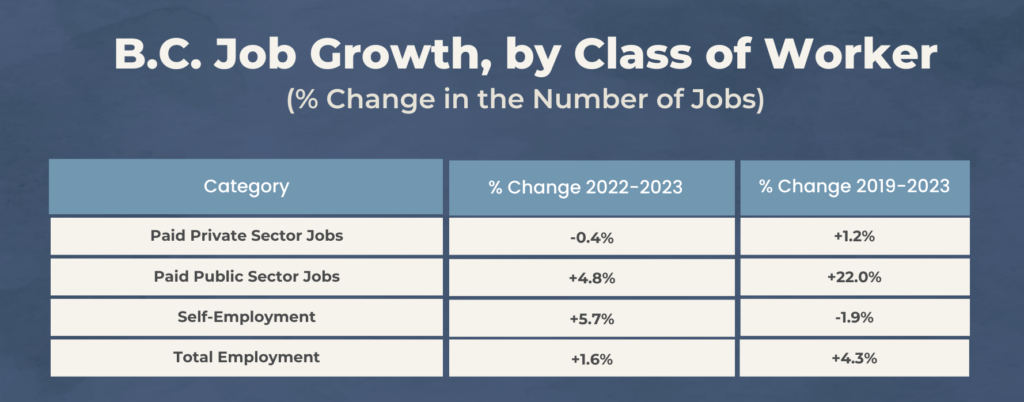

More compelling evidence emerges from an examination of the pattern of job growth across the broad public and private sectors – not just in 2023, but over the last several years. Table 2 provides the details. The number of private sector payroll jobs in B.C. actually fell last year, while public sector employment jumped by almost 5%. Self-employment also rose significantly, up by 5.7%. Within Canada, B.C. was the only province to experience a contraction in private sector payroll positions in 2023.

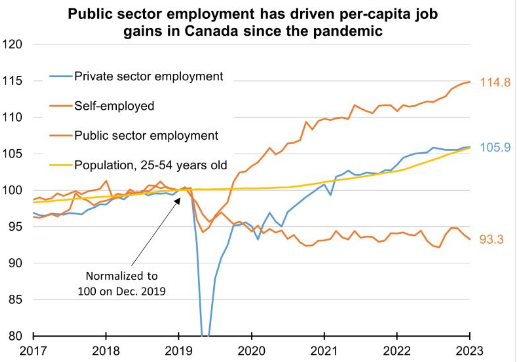

Looking at the period from 2019 to 2023, the picture is more worrisome. It turns out that B.C. has added comparatively few net private sector jobs in the past four years, despite a fast-growing working age population. Over the same time, the number of government-driven jobs has increased by leaps and bounds – up a staggering 22% since 2019. This points to an unbalanced labour market, one where the public sector is expanding briskly while much of the private sector is struggling. Something similar has happened in Canada, as shown in the accompanying chart. However, B.C. stands out within Canada for the feebleness of job creation in the business community and the outsized reliance on the public sector to generate employment growth.

Eye on Construction

As noted above, employment in the B.C. construction sector declined marginally last year. A number of factors were behind this. Work on a handful of multi-billion-dollar capital projects is winding down. Activity in the residential housing industry has cooled amid much higher interest rates, escalating building costs, and unprecedented challenges around housing affordability. The manufacturing, natural resource and transportation infrastructure sectors which supply or enable the bulk of B.C.’s international exports continue to face a difficult operating environment as a result of complex and more onerous regulatory regimes, rising government-imposed costs, and the growing tension between governments’ sweeping climate policy ambitions and the need to maintain a competitive business environment. All of this has implications for construction companies, contractors and their employees.

Employment (actual, not seasonally adjusted) in the B.C. construction industry averaged 235,000 last year, 0.6% below the level recorded in 2022. Back in 2019, 250,000 British Columbians were earning a living in construction. While employment has dipped, many B.C. construction companies are still clamouring for talent. In fact, according to ICBA’s 2024 Wage and Benefits Survey, 79% of the respondents say their businesses are suffering because of insufficient numbers of qualified trades. ICBA believes demand for construction workers and employment in the industry will rise in the coming years, in part due to an expected ramping up of residential construction activity along with the effects of an aging construction workforce and high levels of public sector capital investment over the rest of the decade.

Conclusion

As the new year begins, it is time for B.C. policymakers to eschew complacency and start paying attention to the economic health and prospects of the private sector industries that together provide 80% of all jobs in the province.

Government decision-makers need to put a higher priority on improving the business climate. The secret sauce of a thriving and innovative economy will not be found in an ever-growing public sector.