By Jock Finlayson, ICBA Chief Economist

Recent news that the Royal Bank has completed its planned takeover of HSBC Bank Canada points to a further consolidation in the country’s banking and financial services sector. It also signals that British Columbia has lost another corporate head office – Vancouver having been where the Hong Kong and Shanghai Bank chose to locate its Canadian headquarters when the global banking giant entered the Canadian market several decades ago.

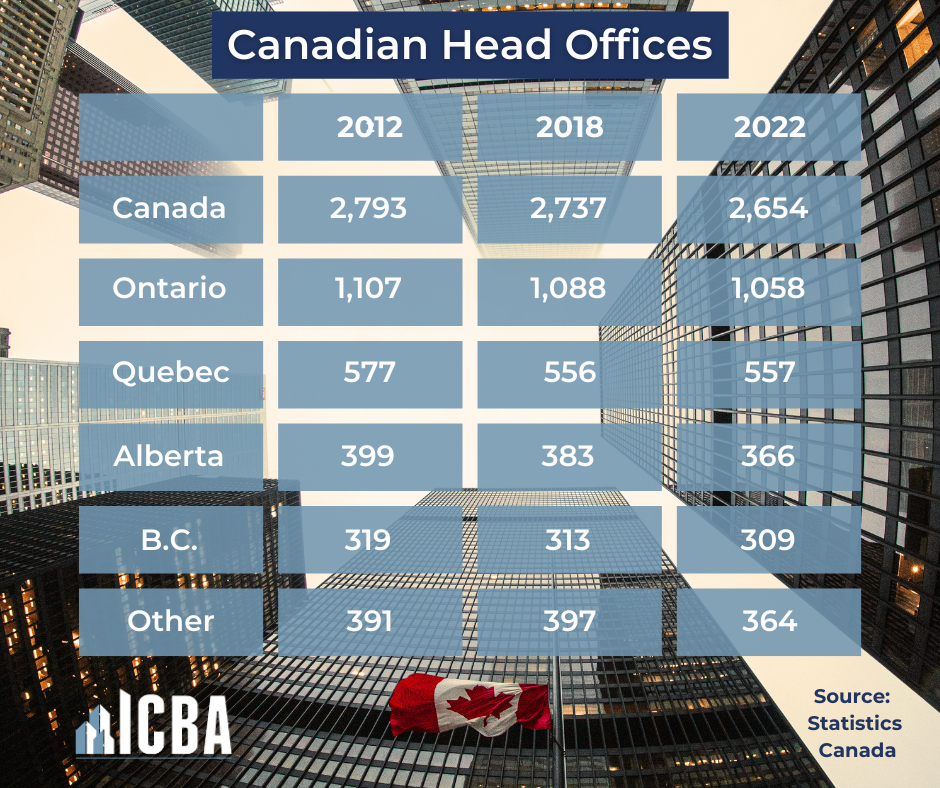

B.C. can ill afford to see its already feeble head office sector shrink. Last month, I poured over Statistics Canada’s latest data set on corporate head offices and summarized the results in a commentary published by the Fraser Institute. The commentary notes that while B.C. is home to 14% of Canada’s population, we host only 12% of the country’s head offices and account for just 7% of nation-wide head office employment.

Alberta, with 800,000 fewer people, outperforms B.C. on both metrics, hosting 14% of the country’s headquarters and 12% of all direct Canadian head office jobs. See Tables 1 and 2 for data on the evolution of head offices and related employment in Canada from 2012 to 2022.

Over the past few decades, B.C. has experienced a significant loss of large and mid-sized company head offices. In part, this is due to foreign takeovers of locally based companies. But the trend also reflects consolidation in the forestry and mining industries, which traditionally have supplied a disproportionate share of the province’s biggest firms.

Against this sobering backdrop, it is worth looking at the place of the construction and real estate industries within “corporate British Columbia.” The 2023 review on B.C.’s biggest companies produced by B.C. Business Magazine sheds some light on the topic.

B.C. Business collects data on the top 100 B.C.-based companies ranked by annual revenues. For the 2023 report, the top 100 companies include 11 that are owned/controlled by the provincial government, leaving 89 that can be classified as “private sector” businesses. Of these 89, seven are construction, real estate, or property development companies: Ledcor, Northland Properties, Anthem Properties, Futura Corp., Polygon, Concert Properties, and American Hotel Income Properties. The revenue cutoff for inclusion in the 2023 top 100 was $291 million. Sitting not too far below that figure are two other real estate-related businesses that are headquartered in B.C.: Wall Financial and City Office REIT. Overall, roughly 10% of the biggest B.C.-based companies, as tracked by B.C. Business, are in the construction/real estate sectors.

I did some additional digging into B.C. businesses via Dun and Bradstreet. Using that source, I identified six other B.C.-headquartered construction companies with annual revenues over $291 million which — for some reason — did not make it into the B.C. Business tabulation: IDL Projects, Emcon Services, Inland Pacific Resources Inc., Heidelberg Materials Canada Limited, Gisborne Industrial Construction, and Flatiron Constructors Canada Limited. Adding these firms to the list compiled by B.C. Business shows that the broadly defined construction/real estate sector looms even larger within “corporate British Columbia,” accounting for around 15% of the biggest B.C.-based businesses.

B.C.’s relatively weak showing on both head offices and direct headquarters employment is concerning. A thriving head office sector brings many benefits to regions and cities. Headquarters jobs are among the most desirable and well-paid in the economy. Research also confirms that a strong cluster of corporate head offices is positively correlated with local incomes, business innovation, charitable activity, and the extent of commercial linkages with external markets. Unfortunately, even with a rapidly expanding population, British Columbia is struggling to grow local businesses and to build and retain significant head offices.

This means the presence of an impressive number of home-grown B.C. companies in the construction, real estate and property development industries takes on added significance. As other industries consolidate, more local businesses are acquired by buyers from elsewhere, and the once dominant B.C. forest industry shrinks, the construction and real estate industries are likely to supply a rising share of the province’s most successful medium-sized and larger companies over the coming decade.