By Jock Finlayson, ICBA Chief Economist

With the 2024 federal budget due to be delivered on April 16th, now is a good time to summarize the major economic challenges facing Canada. ICBA Economics believes that two challenges stand out, and they are closely linked: weak/non-existent gains in real gross domestic product (GDP) per person, which is the principal metric used to gauge living standards; and Canada’s dismal record in the important area of productivity growth.

Gross domestic product is the value of production in a market economy, after stripping out the cost of “inputs” used to produce goods and services. It doesn’t capture everything that matters to people: the distribution of income; the environmental impact of economic activity; the strength of family and community bonds; the subjective happiness of the population; etc. Nonetheless, many studies find a positive correlation between GDP per person and other measures of living standards: educational attainment, health status, longevity, female participation in the workforce, and numerous other socio-economic indicators of well-being. More money doesn’t guarantee greater happiness, but it helps.

Over time, increases in economy-wide GDP translate into higher incomes for workers and households. Without economic growth, it is almost impossible to raise real wages and incomes for the broad population.

There are basically two ways to increase real GDP per capita:

- Adding more labour input. This has been the Canadian strategy in the past several years – expanding the size of the workforce by increasing labour force participation rates among women, Indigenous, and other “under-represented” groups, and by boosting immigration. This strategy produces some benefits, but it has delivered feeble gains in per person GDP.

- Producing more output per hour worked (i.e., increasing productivity).

The second approach – raising productivity – yields stronger and more sustainable gains in living standards.

If we increase real GDP per person by 2% per year, average incomes double in 35 years; at 1%, it takes 70 years; at 0.5%, 139 years must pass before the average income doubles.

Canada’s Performance

Economic growth – both overall and per person – was generally quite robust in the first 2-3 decades after World War II. It then slowed in the 1970s and beyond, with occasional spurts along the way. Canada generally followed the trajectory of other advanced economies in the initial post-war growth acceleration, as well as the subsequent slowdown.

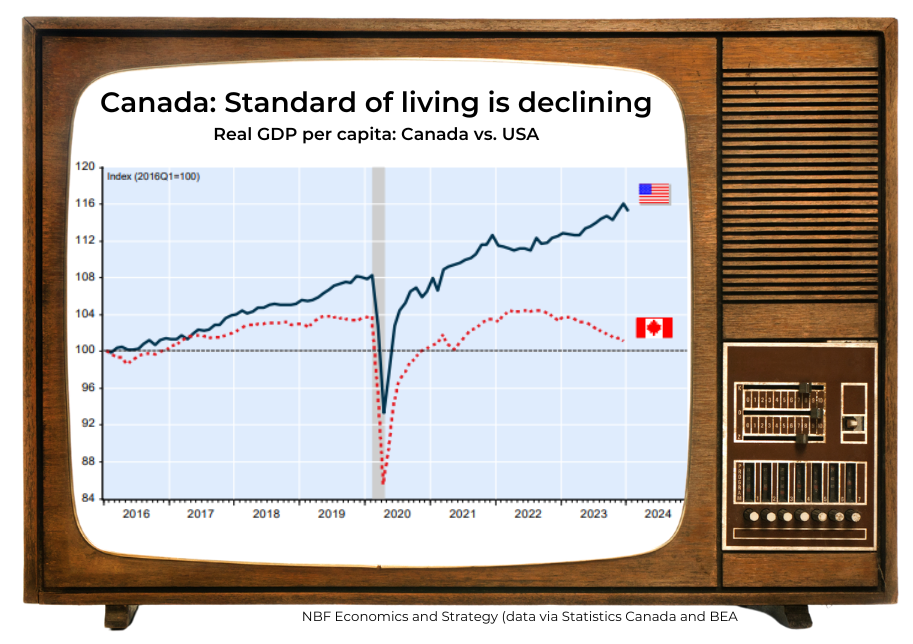

In the past decade or so, things have shifted. While the overall economy has expanded, the population has risen at a similar pace. As a result, Canada has recorded meagre growth in inflation-adjusted GDP on a per person basis, and also per hour of work (labour productivity). Economic growth in Canada overwhelmingly has come to rely on an ever-expanding work force, fueled by rising levels of in-migration.

Specifically, Canada’s per person GDP increased by just 0.8% per annum in the past decade. Over the past seven years, it has essentially flatlined, marking the country’s worst performance since the 1930s. This is not mainly due to COVID: the U.S. has significantly outpaced Canada in per person GDP growth over the same period, even though it was hit even harder by COVID than we were. Recently, Canada’s real GDP per person fell around 2% in 2023 and it will dip again this year. This reflects a combination of above-average population growth and sluggish increases in total GDP, following an initial post-pandemic growth spurt in late 2021 and 2022.

Focus on Productivity

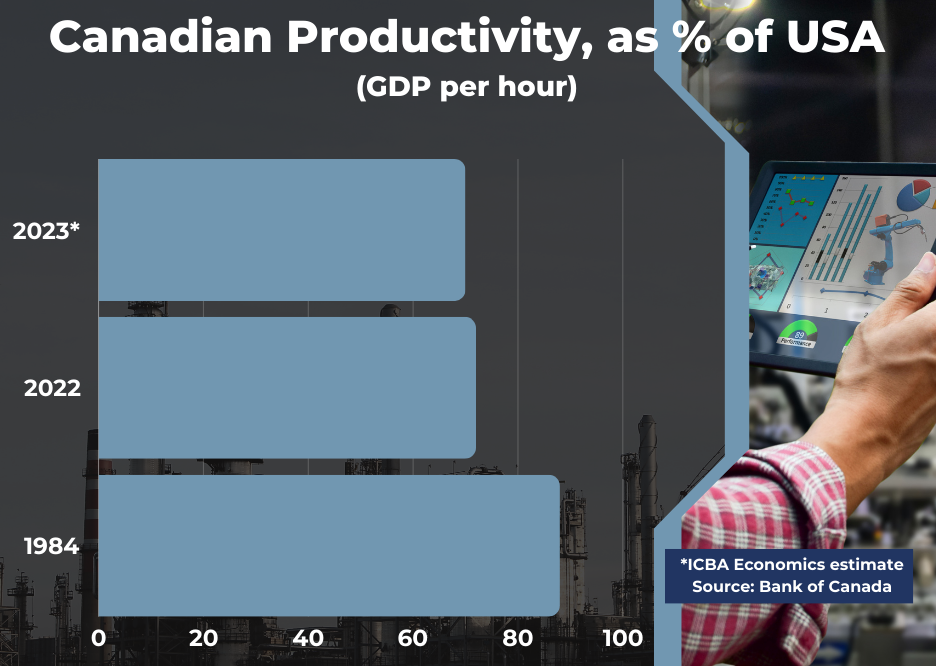

The main reason why per person economic growth has lagged in Canada is that productivity has been stagnant. In fact, output per hour (labour productivity) has fallen in 11 of the past 14 quarters – an unprecedented development, and one not replicated in the U.S. or most other advanced economies.

Compared to the U.S., Canada’s performance has been dismal. In the mid 1980s, output per hour worked was 88% of the U.S. level; today, it is around 70%, and it’s still falling as the U.S. outperforms Canada, year after year, in boosting productivity, driving innovation, and scaling businesses.

In the past decade, unusually weak investment has been a key factor depressing productivity in Canada. Since the late 2010s, Canadian businesses, collectively, have been investing less than 60% as much their American counterparts, measured on a per employee basis, in the tools, technologies, plant and equipment, infrastructure and intellectual property products that enable workers and firms to become more productive. Canada has also trailed the advanced economies as a group in capital investment, outside of the housing sector. In fact, new business investment is running below the level required to offset ongoing depreciation of the country’s productive capital stock, as documented by the Fraser Institute and the C.D. Howe Institute.

Absent a sustained upswing in business investment, there will be no chance of reversing Canada’s slide down the global productivity league tables, nor of narrowing the yawning gap that has opened up with the United States and other high-performing developed economies.

McKinsey Global Institute recently calculated that returning to the long-term U.S. productivity growth rate of 2.2%, vs. 1.4% from 2005 to 2020, would yield a cumulative $10 trillion increase in American GDP by 2030. This is equivalent to boosting the income of a typical household by $15,000 by 2030. Similar gains per household are possible for Canada if we can revive productivity growth to match the country’s long-term average.

Policy Directions

Beginning with Budget 2024, the federal government should pivot its overall economic growth and development strategy away from the recent focus on record levels of immigration to drive rapid population growth. Instead, policy should aim to spur productivity and business investment, foster innovation, expand the suite of export-capable Canadian firms, enhance the success of our existing export engines (including energy firms), and pursue competitive excellence.

The last major Canadian tax review was the Carter Commission in the 1960s. To prosper, we must retool and simplify taxation to meet the needs of a 21st century economy that must be innovative, export more, and compete globally. A commitment to comprehensive tax reform should be announced in Budget 2024. The burden of taxation should be shifted from investment, capital formation and entrepreneurial risk-taking to consumption-related activities. And the federal government should scale back its size and shrink its bloated payroll after almost a decade of explosive growth in expenditures and personnel.

Modernize, streamline and lessen the burden of regulatory processes for industrial development, linear and other infrastructure projects, and construction generally. It shouldn’t take 5-8 years to build a new apartment or office tower. Canada ranks near the bottom in the length of time it takes to obtain the necessary permits to construct a warehouse or a new mid-sized industrial facility. Port Metro Vancouver’s Roberts Bank Terminal 2 project will have taken a decade to go through the various regulatory processes required to put a shovel in the ground; in that time, China will add several dozen new marine container handling terminals. Put simply, Canada is being left behind in the global race to fortify supply chains, “friend-shore” manufacturing in sensitive sectors, and grow exports.

Governments that have embraced ambitious “clean economy” goals and targets must realize that making significant progress will require many hundreds of billions of dollars of investments to climate-proof infrastructure, update the capital stock of Canada’s leading export industries, and build out and expand electricity generation and transmission – particularly since electrification is the only way to significantly reduce reliance on fossil fuels across the economy. Getting even halfway to the federal government’s 2030-35 climate targets will be impossible under current project review, development and permitting regimes (including those under the provinces’ jurisdiction).

Government industrial and economic development policies should move away from subsidizing a few politically favoured sectors and firms. Instead, policy should put a high priority on scaling Canadian-based companies, championing and promoting entrepreneurial wealth creation across the economy, and strengthening anti-trust rules and enforcement to encourage greater competition in protected markets.