Chris Gardner, President, ICBA

In this Monitor, we highlight the challenges of moving forward with important infrastructure projects. We dig a little deeper into Site C, following the release of the BC Utilities Commission preliminary report.

That report is consistent with the outcome of the independent review panel that studied Site C for 29 months, and concluded it is the best way for B.C. to lock-in a source of clean power for the next 100 years. IBCA representatives spoke in favour of Site C at BCUC public forums in Vancouver, Prince George and Fort St. John.

It was frustrating to see provincial lawyers in Federal Court in an effort to scuttle the Trans Mountain Pipeline Expansion just as construction is about to begin. This after a decade of effort, extensive independent review, and federal and provincial approvals (subject to 194 conditions that will be rigorously enforced).

We were also disappointed to see the provincial government decide to review the Massey Tunnel replacement – one of the most dangerous traffic choke points in Canada. Metro Vancouver is growing fast and we need better transit and new roads and bridges. This is not about choosing one project over the other – it’s about the infrastructure investments that will enable businesses to compete and families to get around safely.

Finally, ICBA recently weighed in on the federal government’s proposed changes to small business corporation tax rules – changes that clearly fail the test of fairness. We should be doing every-thing we can to promote and support entrepreneurship, not penalizing the Canadians behind the small businesses that are the lifeblood of our economy. The family-owned restaurant, the mom-and-pop corner grocer, the boutique hotel, and the local construction contractor are all unfairly targeted by these proposed measures.

Site C: Do We Want a Return on Our Investment?

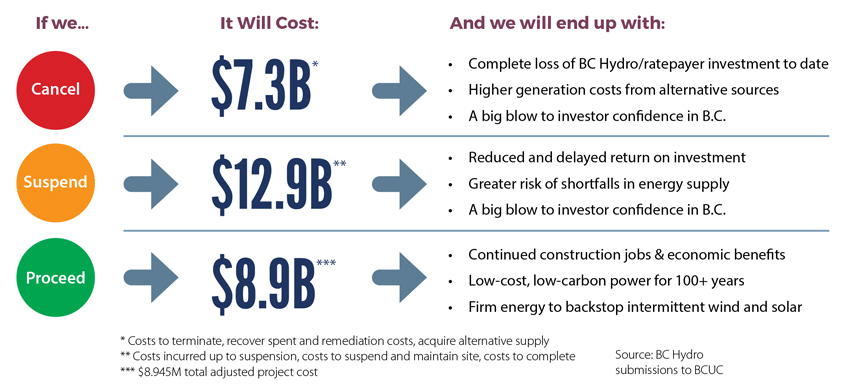

Construction of the Site C Clean Energy Project is well advanced and has the potential to generate – among many other benefits – 10,000 person-years of direct employment and $3.2B in provincial GDP. Even with a recent budget adjustment to address geotechnical issues, the cost of cancelling is still only moderately less than the cost of proceeding – with a vast difference in the return we’d end up with.

Site C: Status Check-In

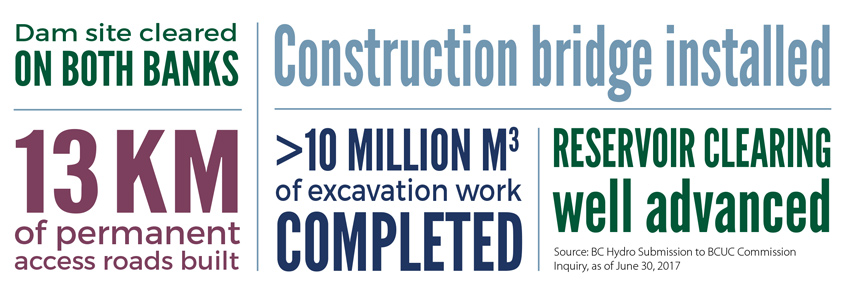

The construction of Site C began more than two years ago, and today it is the largest construction site anywhere in the province. In addition to the engineering marvels that make up the project itself, the site includes a residential facility housing many of the >2,600 people currently working there, 81 per cent of whom are British Columbians.

Completed Work to Date Includes

Project Timing:

While BC Hydro recently concluded that river diversion will have to be pushed back by a year from its original target date, the project was managed from the start for completion a year ahead of schedule. Additional time contingencies remain built into additional contracts. Conclusion:

“We are confident we can still deliver this project on time, by November 2024.”

– BC Hydro President & COO Chris O’Riley, Update to BCUC, Oct. 4, 2017

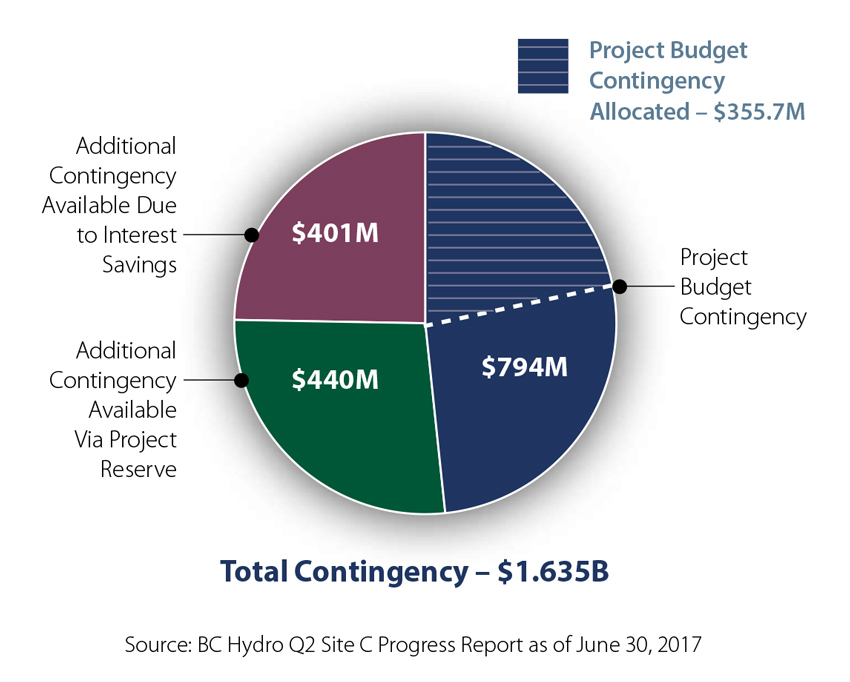

Project Spending:

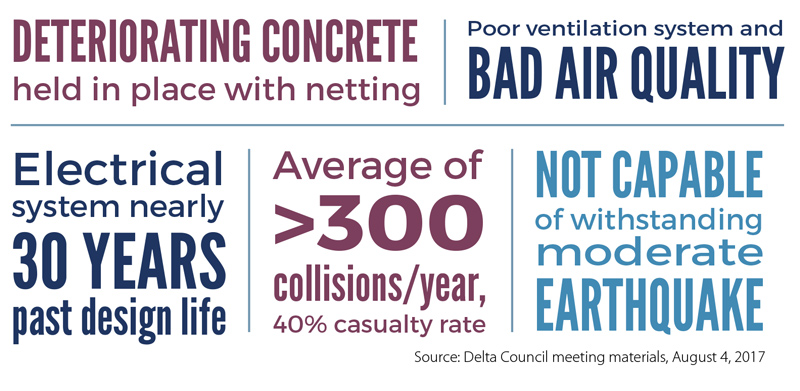

Massey Tunnel Replacement in Limbo

This vital infrastructure project has been suspended and also sent for further review. Supported by three in four Metro Vancouver residents, the replacement would address a traffic bottleneck causing 60,000 hours in delays every year. The 10-lane bridge has been conclusively found to be the cheapest option – with recent indications that it could be built for well under the $3.5B budget – and outperforms alternatives on safety, environmental and agricultural criteria.

The Nearly 60-Year-Old Tunnel Today

Status of Suspended Replacement Project

- 4 years of consultations with public, First Nations, local governments

- 145 technical and scientific reports developed

- Approved by BC Environmental Assessment Office and Agricultural Land Commission

- Construction began in April 2017

- $28.8M in site-preparation contracts awarded

- Project expected to generate approximately 9,000 direct jobs

- Provincial government spending to date of $66M

- BC Hydro spending of $25M on transmission relocation

- Suspension will result in up to $4M in payments to bidders on major works contract

Small Business and the Federal Tax Changes

Dave and Brenda are equal shareholders in a family home-building business, Buildco. Dave and seven employees do the onsite work, while Brenda handles scheduling and bookkeeping from their home office. Here’s how current federal tax proposals would affect this hypothetical but representative couple.

| Current | Proposed |

| Buildco pays 12.5% tax on its income, with the rest paid out equally to Dave and Brenda as dividends, allowing them to slightly reduce their overall tax burden. | Dave and Brenda will have to document their respective contributions to the business in detail. CRA will then decide if the equal dividend split is justified, based on its assessment of the value of those contributions. If CRA decides the equal split is not “reasonable”, one of them will pay a higher tax rate and they will likely have to go to the expense of restructuring their shares in Buildco. |

| Buildco is now earning more than Dave and Brenda need to live on, so they are retaining some earnings in the company – to finance growth, cushion against downturns, and fund their retirements. Earnings from passive investments made with the retained income are taxed at a lower corporate rate.

|

Punitive tax rates – potentially upwards of 70% – will apply to the investment earnings, meaning it may be better to pay out all of Buildco’s income as dividends. This despite the fact that, since they earn their income as dividends, Dave and Brenda don’t have any eligible RRSP contribution room.

|

| Dave and Brenda’s son Chris has spent his career working for Buildco, and they would like him to take over the business at some point. When that happens, they’ll pay capital gains tax at a rate of 23.85%. 1

|

Because this is a family transaction, a tax rate of up to 40.95% will apply to Chris’s share buyout. If they sold the business to an unrelated party, the rate would remain 23.85%.

|

| Dave and Brenda have retired, and are redeeming their preferred shares in Buildco, giving them $40,000 each annually in dividends as their sole source of income. After tax credits, they each pay about $1,000 in tax.

|

“Tax on Split Income” rules will require them each to pay about $16,000 in tax – creating a nearly 40% drop in the after-tax income they believed they could count on when they structured their retirement plan.

|

1: Setting aside possible availability of some portion of a lifetime capital gains exemption. Source: ICBA Submission on Proposed Federal Tax Changes for Small Business Corporations https://www.icbaindependent.ca/