The following was written by ICBA Chief Economist Jock Finlayson.

The B.C. government has just released an updated ten-year labour market forecast, which projects approximately one million job openings between 2023 and 2033. Of these, two-thirds are replacement positions to be filled as existing workers retire or otherwise leave the labour force, while one-third are “new” jobs created by economic growth, business expansion, and ongoing industrial dynamics (basically, in a market economy some industries grow while others contract over time). The government forecasts that employment growth will average 1.2% per year over the next decade. Table 1 provides a few highlights from the 2023 report.

Table 1

Sources of Labour Supply

The government predicts a rough “balance” between the supply of new workers and aggregate labour demand – that is, no structural labour shortage is expected to develop.

In part, this reflects assumed high levels of immigration, which is consistent with recent trends showing growing numbers of both permanent and temporary immigrants. Other factors that contribute to replenishing and slowly increasing the province’s labour supply include positive net interprovincial migration, higher labour force participation rates by older age cohorts, and a rising employment rate among Indigenous British Columbians. In addition, almost half a million young people are expected to enter the province’s workforce in the next decade.

Overall, almost 48% of future job openings are expected to be filled by young adults entering the workforce, with 46% filled by immigrants and the rest by interprovincial migrants.

One part of the report’s labour supply scenario that invites skepticism is the prediction that B.C. will experience positive interprovincial migration, welcoming a net 72,000 working-age individuals from the rest of Canada by 2033. Recently, B.C. has seen net out migration to other provinces, notably Alberta, a pattern that we believe is likely to persist and perhaps gain momentum given the challenges around housing affordability in this province and the fact that private sector employment growth has been feeble in the last several years.

Labour Demand by Industry

Collectively, five industries – including construction – will account for 55% of all job openings in B.C. to 2033.

- Health care – 166,300 openings, 17% of the total.

- Professional, scientific, and technical services – 142,400 openings, 14% of the total.

- Retail trade – 103,700 openings, 10% of the total.

- Education – 70,500 openings, 7% of the total.

- Construction – 66,600 openings, 7% of the total.

For four of the above five industries, a majority of the projected openings are “replacement” positions. Professional, scientific and technical services is an exception, with more than half of future vacancies due to growth of the sector.

In the case of construction, of 66,600 estimated job openings in the next decade, 54,300 will arise because of retirements/other workforce exits while 12,400 reflect industry growth. Within the broad construction sector, employment is projected to grow by 0.5% per year between 2023 and 2033. Table 2 provides additional detail on expected job openings in the main segments of the B.C. construction industry.

Occupational Outlook

Job vacancies by occupation are organized into the ten biggest occupational categories. In the next decade, the following five occupational groups will account for almost four-fifths of all job openings in the province:

- Sales and services occupations – 225,300, openings, 23% of the total.

- Business, finance and administrative occupations – 175,900 openings, 18% of the total.

- Trades, transport and equipment operator and related occupations – 156,000 openings, 16% of the total.

- Education, law, social, community and government service occupations – 123,300 openings, 12% of the total.

- Natural and applied sciences and related occupations – 109,000 job openings, 11% of the total.

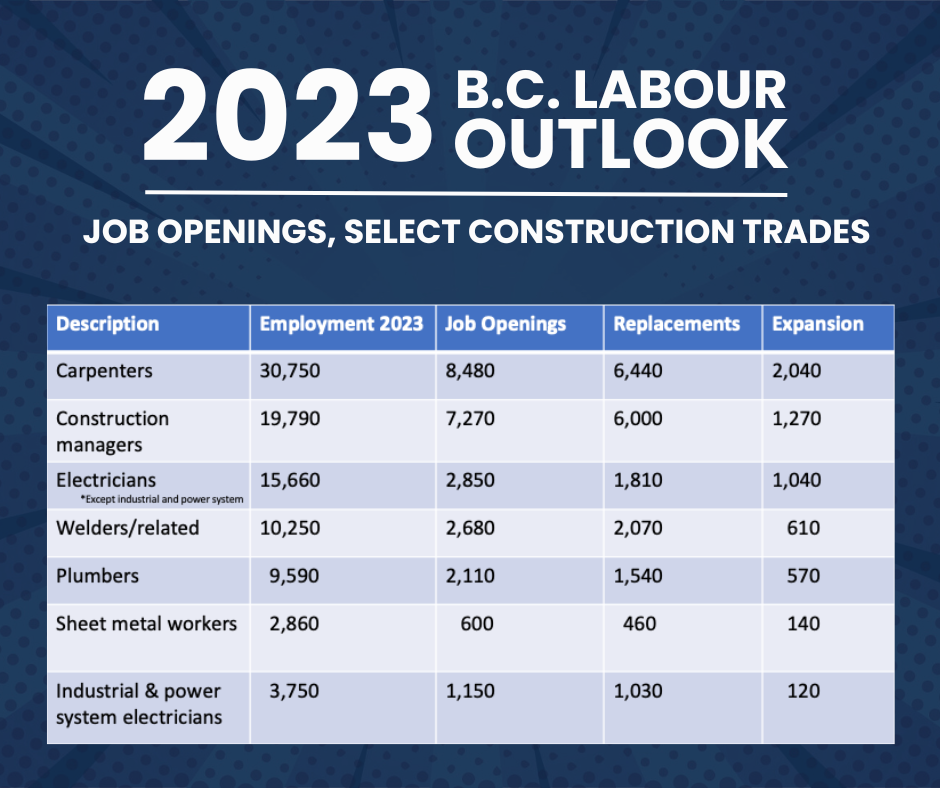

Table 3 shows the pattern of job openings in several construction-related occupations, including the mix of replacement and new positions.

What’s Missing

The report notes that the projections for employment levels and job vacancies in the construction industry do not consider the impact of the NDP government’s “Homes for People” program announced in April 2023 – or other, more recent initiatives that will see the province allocate more money to build additional rental and non-market housing. Given persistent shortfalls in the construction of new housing relative to demand as well as the housing affordability crisis gripping much of the province, it is possible to imagine a future in which homebuilding expands significantly in British Columbia. If so, then the demand for construction workers will exceed the forecasts in the 2023 Labour Market Outlook report.

On the other hand, the report does take account of the imminent winding down of a handful of large energy and infrastructure projects that have supported tens of thousands of construction jobs in B.C. over the last half decade. No new industrial or infrastructure developments of comparable size are included in the forecast of future construction job openings. This means there is some “upside” potential for construction in B.C. to grow beyond the parameters assumed in the report – for example, if more major mining or LNG projects advance in the next few years. ICBA believes the B.C. government would be well advised to consider policy and regulatory changes to kickstart industrial and infrastructure projects in sectors like energy, mining, transportation and manufacturing.