By Jock Finlayson, ICBA Chief Economist

Statistics Canada has just published its latest report on non-residential capital spending. The release provides new estimates for investment expenditures over 2022-23 and a forecast for 2024, based on a survey of private and public sector organizations completed in the fall of 2023. The two main categories of investment covered are non-residential construction and machinery and equipment. Residential investment is not included.

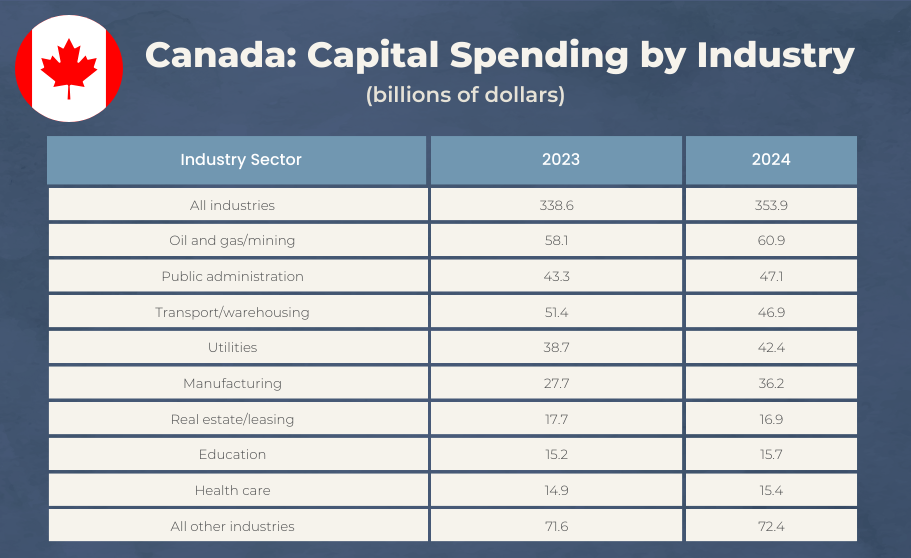

Last year saw a solid increase in Canadian non-residential investment spending, with total private and public sector outlays coming in at $339 billion, up from $313 billion in 2022 and just $275 billion in the COVID-wracked year of 2021. For 2024, nation-wide investment spending is projected to rise by 4.5% to reach $354 billion. Both the private sector (+4.8%) and the public sector (+3.9%) are on course to dial up capital expenditures this year.

The number one sector for investment in Canada remains upstream oil and gas/mining, with capital expenditures in 2024 set to climb to $61 billion (+4.8%). This follows earlier back-to-back gains over 2022-23. This year, investment in the oil and gas/mining sector will be almost twice as high as it was in 2020. The oil and gas sub-sector is on track for an investment surge of 8.2% in 2024, a finding that underscores the outsized contribution the industry continues to make to Canada’s prosperity. Oil and gas is also – by a wide margin — the country’s leading export industry.

Table 1 provides data on investment outlays by broad industry category. Apart from oil and gas/mining, industries with unusually high levels of capital spending are transportation and warehousing, utilities, and manufacturing. Public administration (government) is also a significant source of investment. Sectors expected to see substantial increases in investment activity in 2024 include manufacturing, utilities, and government (public administration).

While private sector capital spending has put in a mixed performance in Canada over the last several years, the public sector has become a bigger part of the overall investment picture. If the Statistics Canada survey results are realized, 2024 will mark the seventh consecutive year of higher public sector capital expenditures, with the sector accounting for approximately 37% of all investment in tangible capital assets. It should be noted that the broad public sector includes public administration, most of health care and education, and government-owned enterprises in industries like utilities and transportation.

Focus on B.C. and Alberta

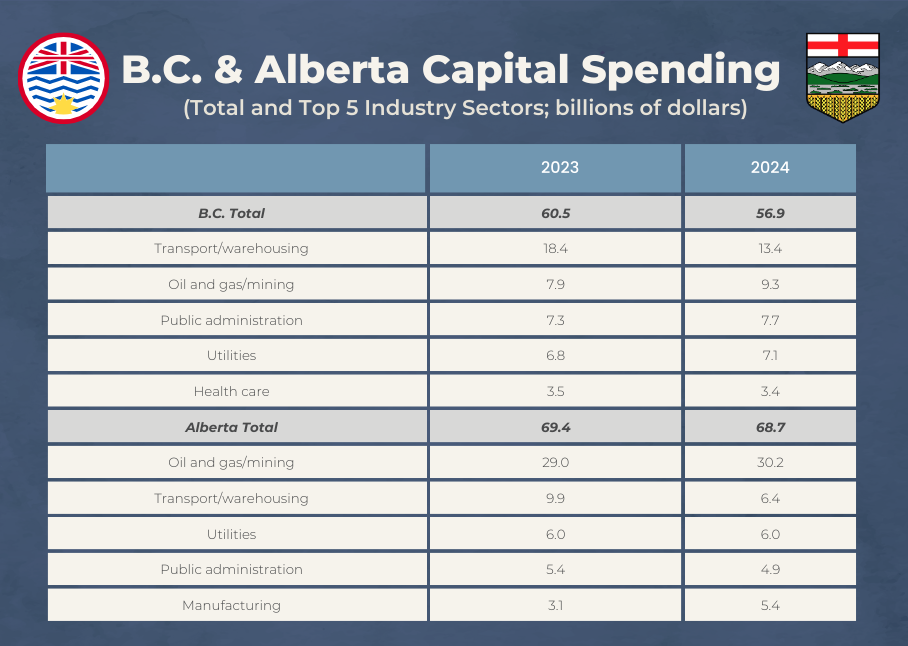

B.C. and Alberta are both expected to see a dip in investment spending this year compared to 2023, which partly reflects the winding down of a handful of large projects. In B.C., capital outlays will fall by more than 5% while Alberta will experience a very slight decline (less than 1%). Table 2 shows total capital outlays as well as investment in the top five industries for the two provinces. For 2024, B.C. is looking at a sharp drop in investment in the transportation/warehousing sector, which includes the pipelines segment. In contrast, investment in B.C.’s oil and gas extraction/mining sector is projected to be higher than it was last year. Whether this actually happens may hinge on policy- and legal-related developments affecting the upstream natural gas industry in northern B.C. and how quickly planned new mines can be built.

Alberta ranks as Canada’s most capital-intensive province, mainly thanks to the heavy presence of energy-related businesses, and this is reflected in Table 2. Total capital spending is roughly one-fifth higher than in B.C., despite Alberta’s population being 800,000 smaller. Oil and gas extraction/mining represents more than 40% of all non-residential investment spending in Alberta.

Overall, the 2024 investment intentions survey is mildly encouraging. Recent studies from the Fraser Institute and the C.D. Howe Institute have found that Canada is badly lagging the United States and many other advanced economies in the level of business investment per worker. Narrowing the investment gap with our principal trading partner will be essential if Canadian policymakers want to avoid a “bad equilibrium” in which Canada falls progressively further behind the U.S. in both productivity levels and real income per capita.