By Jock Finlayson, ICBA Chief Economist

Nationally, investment in building construction fell slightly in January 2024. Investment was lower (-1.4% month-to-month change, seasonally adjusted) in the residential segment, while non-residential building investment edged up 0.2%. Stripping out the effects of inflation, total building instruction investment was down by 0.9% in January measured in constant dollar terms.

In January, residential building investment in B.C. dipped by 2.3% from the previous month. In Alberta, residential investment was unchanged. Meanwhile, non-residential building investment fell 1% in B.C. while posting a slim 0.2% month-to-month advance in next-door Alberta.

Note that the residential sector typically accounts for about 70% of all construction investment spending in Canada.

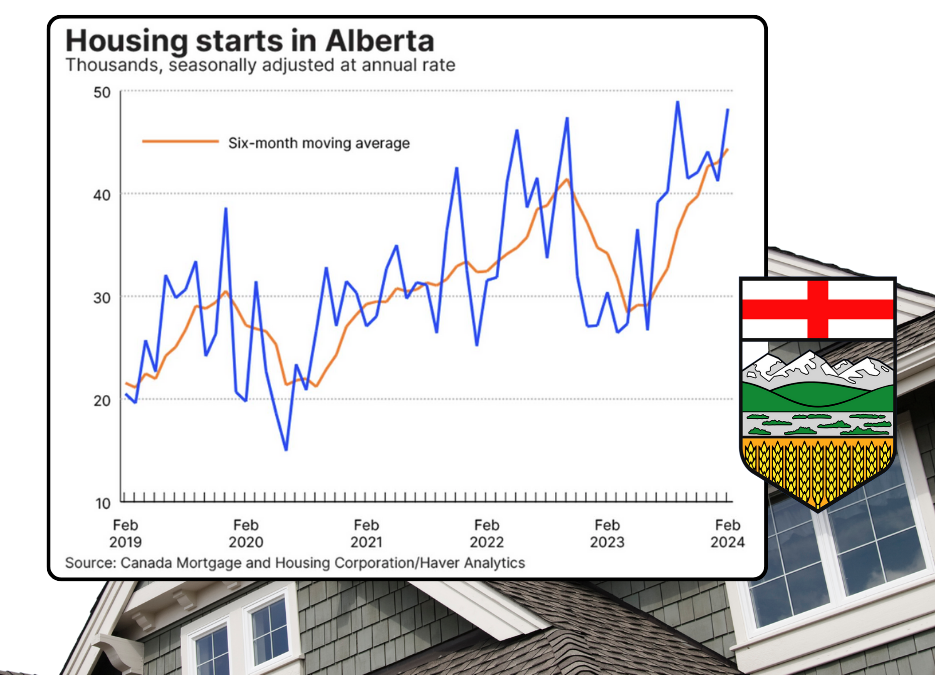

Related data suggest a firming in residential construction activity in Alberta, in particular, with housing starts in February up 17% from the prior month to 48,240 (annualized). That marked the seventh consecutive month of starts running north of 40,000.

Alberta is leading the country in the pace of housing starts. According to ATB Economics, even amid high building costs and still high interest rates, “builders see strong demand for new homes” as Alberta’s population continues to surge. ATB Economics projects that 2024 housing starts will be up 14% over last year’s level.

The picture is more subdued in B.C. The recent B.C. government budget sees housing starts declining by 9% this year.

Recent data on building construction and housing starts confirm that Alberta remains well positioned to top the provincial economic growth charts this year as B.C. struggles to eke out any gains in output and also faces a weaker capital spending profile across much of the private sector.