This Mental Health Week (May 6-12, 2024), ICBA reaffirms our commitment to enhancing mental wellness in the construction industry. Our award-winning ICBA Wellness program focuses on creating a supportive environment where mental health is a priority, recognizing the...

ICBA ECONOMICS: Focus on B.C. Construction Labour Supply & Demand

By Jock Finlayson, ICBA Economics The availability and cost of qualified workers is a day-to-day concern for many ICBA members as well as for the construction industry generally. As a large and foundational economic sector, construction remains critically dependent on...

TRAINING THURSDAY: Defending Your Digital Frontier – Navigating Cyber Risks for Business Success

Kerry and Jordan talk about ICBA’s latest featured course. Defending Your Digital Frontier: Navigating Cyber Risks for Business Success FREE! | Live Online May 29, 2024 | 9:30-11AM Pacific Time...

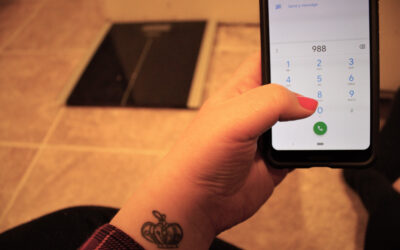

WELLNESS WEDNESDAY #148: Suicide Prevention

This month at ICBA Wellness, we’re looking at suicide prevention – ways to help both ourselves and others, and to connect to important services at the moment of need. In the past year, Canada took a giant leap forward with the launch of 9-8-8, a national suicide...

MERIT CANADA: A Wild Spending Spree Masquerades as a Budget

The federal budget continues years of unsustainable government spending, ever-increasing debt, and a lack of any focus on the need to attract investment and improve productivity, says the Spring 2024 edition of Merit Canada’s Canadian...

TRAINING THURSDAY: Navigating Taxes for Small Businesses and Self-Employed Individuals

https://youtu.be/iTGmeOifn7s Kerry and Jordan talk about ICBA’s latest (FREE!) featured course. Navigating Taxes for Small Businesses and Self-Employed Individuals Live Online | FREE! Tuesday, May 7, 2024 | 11AM – 12:30PM Pacific Time Register at...

ICBA ECONOMICS: Household Formation, Immigration and Housing Markets

By Jock Finlayson, ICBA Chief Economist The 2024 federal budget unveiled dozens of new initiatives intended to address Canada’s unfolding housing affordability and supply crisis. Never before have Canadian politicians been so seized with housing-related issues. At the...

WELLNESS WEDNESDAY #147: Economic Advocacy is a Mental Health Issue

ICBA is Canada’s largest construction association and we grew to this size largely due to our strong advocacy for the conditions that help builders succeed: a strong economy, less red tape, lower taxes, and open, fair bidding. We also run an award-winning workplace...

ICBA/BCBC OP-ED: B.C.’s natural resources remain central to our collective well-being

ICBA Chief Economist Jock Finlayson and Business Council of B.C. Chief Economist Ken Peacock co-wrote the following op-ed, which was published in Business in Vancouver April 19, 2024. British Columbia’s natural resource industries—forestry, mining, energy and...