The following was authored by Jock Finlayson, ICBA Chief Economist.

The construction industry across Canada has been grappling with sharply escalating building costs for the last several years. The direction of travel for costs is still pointing upward, but the pace of increases seems to be moderating.

In Q3, national residential building construction costs rose by 1.0%, down from 2.0% in Q2, according to the most recent Building Construction Price Index (BCPI). The BCPI is a quarterly series that measures change over time in the prices that contractors charge to construct a range of residential and non-residential buildings. The contractor’s price includes the value of all materials, labour, equipment, overhead and profit to construct a new building. It excludes costs for land, design, land development, and real estate fees.

Non-residential building costs were up 0.9% in the latest quarter, on the heels of a 1.6% increase in Q2. According to Statistics Canada, “this marked the slowest quarterly growth in…building costs” since the COVID shock in 2020.

On a year-over-year basis, a pattern of rising costs persists. Residential building costs in Q3 in the 11 largest Canadian cities were 6% higher than in same quarter last year, with non-residential costs 5.9% higher. Significant parts of the Canadian construction industry continue to face labour shortages and supply chain challenges affecting the prices and availability of certain building materials. Government policies, fees/levies, regulations and administrative processes are also an important and ongoing cost driver for the construction industry, particularly the residential segment.

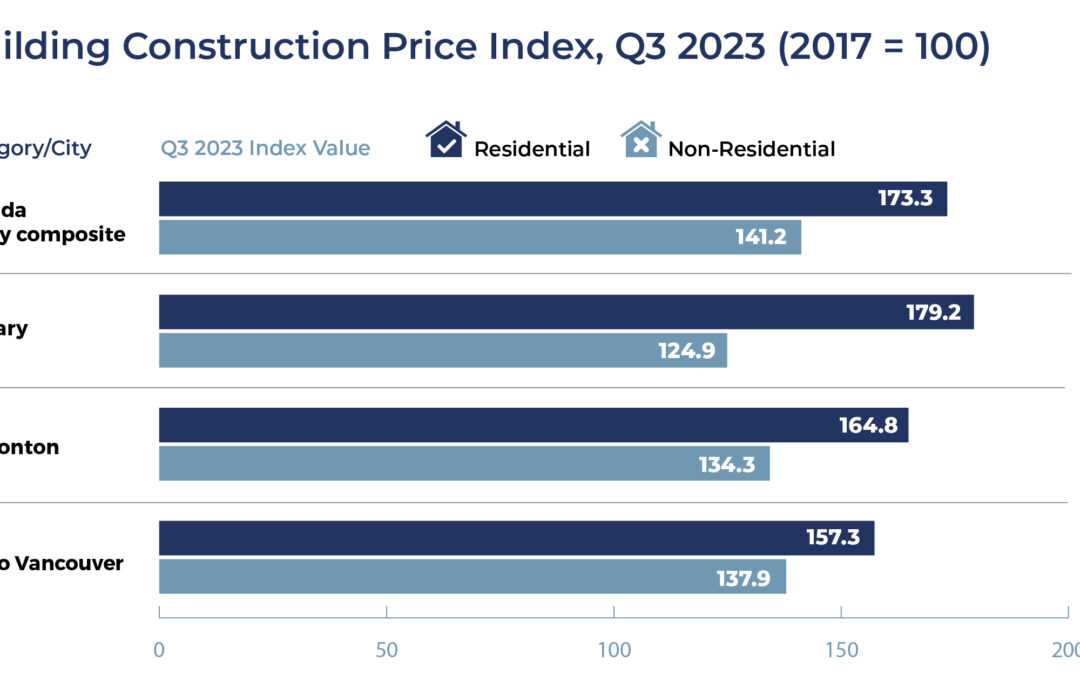

The chart above shows the latest Q3 construction price index figures for residential and non-residential building for the largest cities in Alberta and B.C. as well as for metropolitan Canada; note that all of the figures are benchmarked to 2017 = 100.

Compared to 2017, residential building costs are now 79% higher in Calgary, 65% higher in Edmonton, and 57% higher in Metro Vancouver. For the 11-city Canadian composite, the comparable increase is 73%. Non-residential construction has been hit with somewhat smaller but still substantial cost inflation.

At a macro-level, inflationary pressures in Canada are easing, and the economy is clearly losing momentum — to the point where some forecasters believe we have already entered a shallow recession. The pain inflicted by higher interest rates has hammered many industries, including construction and real estate development. With economic growth in Canada expected to be almost non-existent in 2024 and an outright recession possible, the cost pressures bearing down on the construction industry are likely to diminish in the next 12 months.